Summary

While notably better than the middle of 2016, the current buy environment for REITs isn't great.

However, if rates remain tame or only mildly tighten, their operations should remain solid on a wholesale level, so investors should feel somewhat comfortable holding here.

Get a shopping list together and wait for knee-jerk reactions, market disconnects, or individual anomalies before buying.

A few thoughts on what to buy (and avoid) in the current market.

As U.S. investors wake up this week with a new President for the first time in 8 years, the very polar response to the nation's 2016 decision continues to put neighbors at odds over collective social and economic policy.

Financial markets, however, continue to vote with a glass-half-full outlook, despite this Main Street division, both in terms of the stock market and the bond market. It will be interesting to watch the market's near-term moves now that DOW 20,000 has been eclipsed.

Although equities have generally trended higher over the past 10 weeks, rate sensitive response has also been polar, depending on the market's assessment of rising rate impact. Banks and financial service stocks have experienced a very rapid rise, while long-term bonds have generally lost price value.

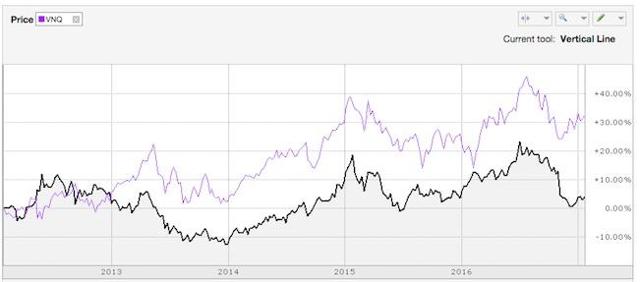

Sitting somewhere in the middle of this are real estate investment trusts. Though the space is generally considered by traders to have similar rate sensitivity to bonds, the sector as a whole (as measured by the VNQ index) has done better than bonds since Donald Trump's election.

VNQ vs. TLT - 5 year chart

Source: Ameritrade

But, REITs ARE NOT BONDS

While most REITs possess a recurring contractual revenue base like bonds, they are generally priced on a longer-term basis via discounted cash flow performance, not interest rate movement or credit rating - although those will factor in as well. Further, unlike your typical bond, most REITs are managed to generate a rising bottom line and dividend growth for investors.

Still, the chart above does show, in my opinion, strong near-term correlation between long bonds and REITs (at least in terms of relative movement). This is a parallel that total-return oriented investors would be foolish to ignore.

But the bottom line is that REIT investors, in most instances, should key in on the golden standard of REIT cash flow generation - Funds From Operations, or FFO. To simply state that the entire group will suffer in a rising rate environment is fallacious. Admittedly, some might, but others probably will not. Lease duration and annual escalators, as I've pointed to many times in the past, are another dual layer of the onion that investors need to comprehend.

It may also be prudent to conduct a study of a trust's net asset value, which gives the investor cues as to how the market is pricing the assets on a real basis. However, that should be considered merely a reference tool and something subordinate to the REIT's ability to monetize its assets. As STORE Capital (NYSE:STOR) CEO Chris Volk once told me in an interview, "NAV has never paid anyone a nickel."

Discount to NAV might be an attractive notion, but it must be considered in context relative to operating metrics. Also, NAV is not an exact science. At times, there may be a rather high large margin of error in cap rate assumptions or what a group of properties might bring in the open market on any one day. The 5% discount to NAV you calculate might, in fact, be a 10-15% discount, especially in a forced sale of assets.

The Macro-Outlook

REITs with attractive balance sheets and some level of property price control have really prospered in the post-financial-crisis ZIRP world. And despite the Fed's recently articulated bias towards tightening, I continue to be skeptical of their ability to follow through to the extent of their current prognostication.

As I've noted before, REITs that operate in attractive growth subdivisions might actually see property level NOI benefit if a higher rate environment were catalyzed by economic strength. But that's probably a big if at this point.

What I think might be more likely in 2017 is that, with either stagnant or luke-warm economic conditions, the Fed moves sooner rather than later on rates. However, it will once again be unable to string together the sequential moves it has implied. That kind of baseline would probably be positive for REITs as a whole, since the market seems to be discounting more rather than less rate movement this year (although less than two months ago).

However, something more intermediate-term or even longer-term should be considered as well. My continuing view is that the velocity and severity of potential rate hikes is the true determinant of future outlook and performance here, not simply "higher rates."

The Micro-Outlook

I consider there to be few table-pounding value opportunities at present, but clearly see now as a much better time to be allocating to the group as opposed to just six months ago.

Getting down to the nitty-gritty of what looks good in 2017, I thought it would be more helpful to create a list of names investors should be potentially adding to their shopping lists, with the lack of "no-brainer" value right now.

2017 Shopping List

REIT Subdivision

|

Conservative

|

More Aggressive

|

Data Centers

|

Digital Realty (NYSE:DLR)

|

DuPont Fabros (NYSE:DFT)

|

Healthcare

|

Welltower (NYSE:HCN)

| |

Industrial

|

Prologis (NYSE:PLD)

|

STAG (NYSE:STAG)

|

Infrastructure

|

American Tower (NYSE:AMT)

| |

Lodging/Leisure

| ||

Mall/Multi-Retail

| ||

NNN-Single Tenant

|

Realty Income (NYSE:O) or STORE Capital

| |

Office

| ||

Multi-Family

| ||

Self-Storage

|

* Landmark is structured as an MLP, not a REIT

** Jernigan Capital is primarily an mREIT (CRE lender)

There isn't a REIT in this list that I'd necessarily be afraid to own at the right price, however, the list of what I'd actually add money to today would be rather short. I think longer-term investors need to think carefully about longer-term trends as they slim down the shopping list.

Omega is widely regarding as a cheap REIT with a good dividend growth track record. With a yield of 7.5% and "10ish" FFO valuation, one might see this as a no-brainer. However, you need to consider the fact that the company's prime HC property is SNF (skilled nursing facilities). Given the vast uncertainties for the future of healthcare and the fact that OHI is much more heavily reliant on reimbursement compared to other property-types, the stock has essentially treaded water for four years.

It may likely continue to do so. Despite the value, I continue to avoid it as I'm not sold on the long-term growth story here. Near-term, I've opted for the higher yield, less attractive financials, yet better long-term NOI visibility of private-pay senior housing property owner, New Senior.

I have a slightly different view for Washington Prime, the lower-tier mall owner that currently trades at a mid-single-digit FFO multiple and 10% well covered yield. Though the market has correctly priced in a discount given the uncertainties related to the "Amazonification" of retail, and its exposure to the lower-tier department store operators (Sears, Penneys, etc...), I think the concerns are a bit overblown.

WPG's mall and open-air properties are generally destination in nature with restaurants and other attractions in close proximity. Further, their exposure to the troubled department stores seems quite manageable with less than 7% of revenue attributable to those players. The company seems adept and proactive at quickly re-tenanting space that goes dark and upgrading the general quality of the tenancy in the process.

The market seems to have priced in a premature going out of business sale here, which I think investors should take advantage of. Still, given the risks, this should admittedly not be a core position for most investors, which is why I listed it in the aggressive column.

In the conservative column, I'd probably still buy MAA, the primarily Sunbelt-situated apartment landlord. While I liked the stock closer to $90 a few months ago, the market is underestimating the stock's quality relative to peers, and doesn't seem to appreciate the potential cost synergies of its acquisition of Post.

I'm still a fan of STORE Capital, despite its big drop off since last summer. The $25 mark seems like a good accumulation point, at less than 15X this year's AFFO with a 4.75% yield and ~70% payout. Contrast that to Realty Income's 20+ multiple, 4.25% yield and ~85% payout.

I've warmed to the long-term growth story in the data center space, but having bought DuPont Fabros aggressively at lower prices in the fall, I'd probably shift to an accumulate at this point. I still consider it a better potential total return and dividend growth story than Digital Realty.

Summary

The breadth of REIT property type and operating model provides investment flexibility for a variety of investor types. This breadth also makes it inappropriate to make blanket statements like "higher rates are bad for REITs."

Still, while I think investors should remain cautiously optimistic on the sector as a whole, it wouldn't surprise me if better buy opportunities appear as the year wears on.

Hone in on the best secular growth stories and buy when the market seems to be acting irrationally. While I doubt we'll see any sort of runaway upside for interest rates, understand which REITs might or might not be more sensitive to such a scenario. Step in when the market appears to be throwing the baby out with the bathwater.

If you enjoyed this article, please "Follow" me to receive dashboard and real-time notification when I publish an article related to dividend stocks, new off-the-beaten-path dividend ideas, bonds, CEFs, interest rates, REITS and the current and forward macroeconomic environment.

I am honored to partner with Seeking Alpha and Investor in the Family as a presenter at the DIY Investor Summit. In total, 25 of the best investors on Seeking Alpha have gathered to share detailed tips on our core investment strategies, top advice for DIY investors, and specific ways we're positioning for 2017. This is a unique event that you will not want to miss. Free registration is now open (for a limited time).

Disclosure: I am/we are long CUBE,DFT,EDR,EPR,HCN,HPP,JCAP,LMRK,MAA,MGP,NSA,SNR,WPG.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: The above information should not be considered or construed as individualized or specific investment advice. Do your own research and consult a professional, if necessary, before making investment decisions.

No comments:

Post a Comment